Way of a Trader Blog

Standard PSEM (Private Seminar) this September 9–10, 2025 in Sydney.

From Trading Buddies to DiNapoli Experts: A Decade with Lawrence

A Personal Note from Joseph AuXano

It’s been more than a decade since Lawrence and I first began our journey into the DiNapoli trading methodology. Back then, we were just two traders searching for something deeper — a system that combined structure, precision, and real-world applicability.

We found that in the DiNapoli Levels… and in each other.

More Recent Psem Event

Throwback to one of our early seminars — young, hungry, and trading like our lives depended on it.

Since those early days, Lawrence has proven himself to be one of the most disciplined, consistent, and generous traders I know. While many fade in and out of the markets, Lawrence has stayed the course — not just as a trader, but as a teacher and mentor to others.

What Sets Lawrence Apart

-

He’s the kind of trader who journals every setup and reviews his trades religiously

...

Introducing DiNapoli Levels on TradingView

Title: Unveiling the DiNapoli Indicator Pack on TradingView: A Game Changer for Traders

Introduction:

Welcome to a transformative trading experience with the DiNapoli Indicator Pack, exclusively available on TradingView. Tailored for traders who seek precision and depth in their market analysis, this indicator pack harnesses the power of DiNapoli Levels to offer unique insights into market dynamics. In this post, we'll explore the tools included in the DiNapoli Indicator Pack and how they can enhance your trading strategy.

Overview of the DiNapoli Indicator Pack:

The DiNapoli Indicator Pack integrates seamlessly with the TradingView platform, providing users with a comprehensive suite of tools designed by Joe DiNapoli, and perfected by Joseph AuXano, for the tradingview platform. These tools are crafted to offer traders enhanced perspectives on market trends and potential price points, aiding in more informed decision-making processes.

Key Tools in the DiNapoli Indicator Pack:

1....

Navigating the Trading View Platform

Introduction:

Welcome back to the DiNapoli Trading Academy! Today, we're excited to guide you through a quick and efficient setup on TradingView, tailored for users of the DiNapoli Indicator Pack. Whether you're a seasoned trader or just starting out, understanding the fundamental tools and features of TradingView can enhance your trading experience significantly.

Navigating the Essentials:

TradingView offers a plethora of tools and features, but today we focus on those essentials that simplify and enhance market charting. Here’s how to make the most of these features:

1. Tools on the Left Panel:

-

Cursors: Toggle between the arrow for a cleaner chart view and the crosshair for detailed price and time data. This allows for precision without clutter.

-

Lines Tab: Utilize tools like the Trend Line, Horizontal Line, and Horizontal Ray for basic to advanced market analysis. These tools are fundamental for drawing support and resistance levels or identifying key trends.

-

Fibo...

Installing the DiNapoli Indicator Pack on TradingView

How to Set Up the DiNapoli Indicator Pack on TradingView

Welcome to your guide on activating the DiNapoli Indicator Pack on TradingView. We'll walk you through each step, from subscription to activation, so you can begin trading with an edge. Here’s how you can get started:

Step 1: Subscribe to the DiNapoli Indicator Pack

Start by clicking the 'subscribe' button below this video. Enter your email—ensure it matches the one you registered with the Academy. This will help synchronize your academy and trading accounts seamlessly.

Step 2: Sign In

After subscribing, you'll be prompted to sign in to your account. This ensures your subscription and account are linked properly.

Step 3: Create Your TradingView Account

If you haven’t set up a TradingView account yet, follow the provided link to do so. Take advantage of any special discount offers on annual plans during their 30 Day Trial Phase. This is a great time to explore the platform without a full commitment.

Step 4: Enter Your Deta...

How to Set Up Your TradingView Account for the DiNapoli Indicator Pack

Welcome to our step-by-step guide on setting up your TradingView account to make the most out of the DiNapoli Indicator Pack. Whether you're a novice trader or a seasoned pro, these instructions will ensure you're well-equipped to navigate the markets with the DiNapoli tools at your fingertips.

Step 1: Registering Your Account

First things first, head over to TradingView.com. By using the referral link provided, you’ll enjoy a $15 discount on your first subscription. Not only does this offer benefit you, but it also supports our academy, as all referral proceeds are reinvested into our community outreach efforts.

To register, click 'Join for free' and fill in your details or use a social media account for quick registration. For a seamless verification process, ensure the email you register with on Trading View matches the one registered with the DiNapoli Trading Academy.

Step 2: Creating Your TradingView User ID

Upon registration, you’ll need to create a TradingView User ID. T...

Oct 2022 Bangkok DiNapoli Masterclass - The Best one Yet!

Traders,

It has been a few weeks since we concluded the OCT 2022 DiNapoli Masterclass, in Bangkok Thailand.

I still find myself reminiscing on the good times, trade discussions, Live Trading, Lessons/Insights, and the camaraderie that we are all fortunate enough to develop over 4 Days of Total Immersion, into the world of DiNapoli Trading.

I've always felt that for DiNapoli Traders, Private Seminars are important milestones in one's trading journey, where important lessons, connections and memories are made - which is why I've placed great emphasis. care and respect, whenever I am a part of these events.

I firmly believe we are nurturing and training the next generation of DiNapoli Traders, and I do not take this Responsibility lightly. The truth is I take pride in knowing that with each Masterclass, I have given absolutely everything to support attendees in their journey with dinapoli levels.

I'd like to take a moment here to share alittle more about the DiNapoli Mastercla...

Details for 2022 Oct 15th - 18th Bangkok DiNapoli Masterclass

Traders,

Please find below the Details for the 2022 Oct 15th - 18th Bangkok DiNapoli Masterclass.

We have made important refinements to the curriculum, after reviewing some of the attendee feedback/suggestions we received recently.

Curriculum

Phase 1 : Pre-seminar

P-sem Onboarding (Online)

There will be an online Meet and Greet, where attendees will get together over a conference call, to go through seminar details,

More importantly, it allows us to learn more about you. There will be a mandatory questionnaire you need to fill - that will help both Joe and myself to better help you during the Private Seminar.

There will also be some homework assignments ( supported by video ), to make sure clients arrive at the P-sem prepared for the sessions.

PHASE 2 : The SEMINAR

Standard Private Seminar ( Led by Joseph AuXano )

DAY 1

1) What is Your Objective as a Trader

2) DiNapoli Tradeplans/Concepts Overview

3) Standard Trade Plan

4) Modified Trade Plan

5) Trading Timefr...

Your DiNapoli Trading Questions Answered - Part 01

Traders,

Recently we posted a video on our youtube channel, that seeks to answer some of the more common questions we have been getting, especially for Traders new to DiNapoli Techniques.

You can watch the video using the link below :

Your DiNapoli Trading Questions Answered Part 01

It will be a part of a video series that we will be adding to over time,

so you will definitely want to check it out!

Thats' all from me for this blog post

Joseph AuXano

DiNapoli Trading Academy

Bangkok May 2022 DiNapoli Masterclass ( Combined Standard & Advance P-sems with Joseph AuXano & Joe DiNapoli )

To all Masterclass Attendees,

Thank you for making this 2022 May Bangkok DiNapoli Masterclass such a pleasurable experience!

What a wonderful group we had!

Lawrence and Kevin, you guys brought with you more than a decade experience with DiNapoli Techniques, it was so good seeing you guys again after so many years!

Igor - great to finally meet you in person. You were every bit the trader/person I have imagined you to be through our communications over email through the years.

Matthew and Acrux, the experience you guys brought to the advance P-sem was great - my pleasure to have met you guys.

Steven, Caryle and Pieng, for new DiNapoli Traders, you guys were really great!

Great questions throughout both the standard and advance segment of the workshop....

Overall, Both Joe DiNapoli and myself were really impressed with the group dynamics - which was why we both felt that this one of the very best Masterclass we have had the privileges to conduct.

Below are some memories fr...

"Re-opening Risk On" VS "Inflation Risk Off". Have markets decided?

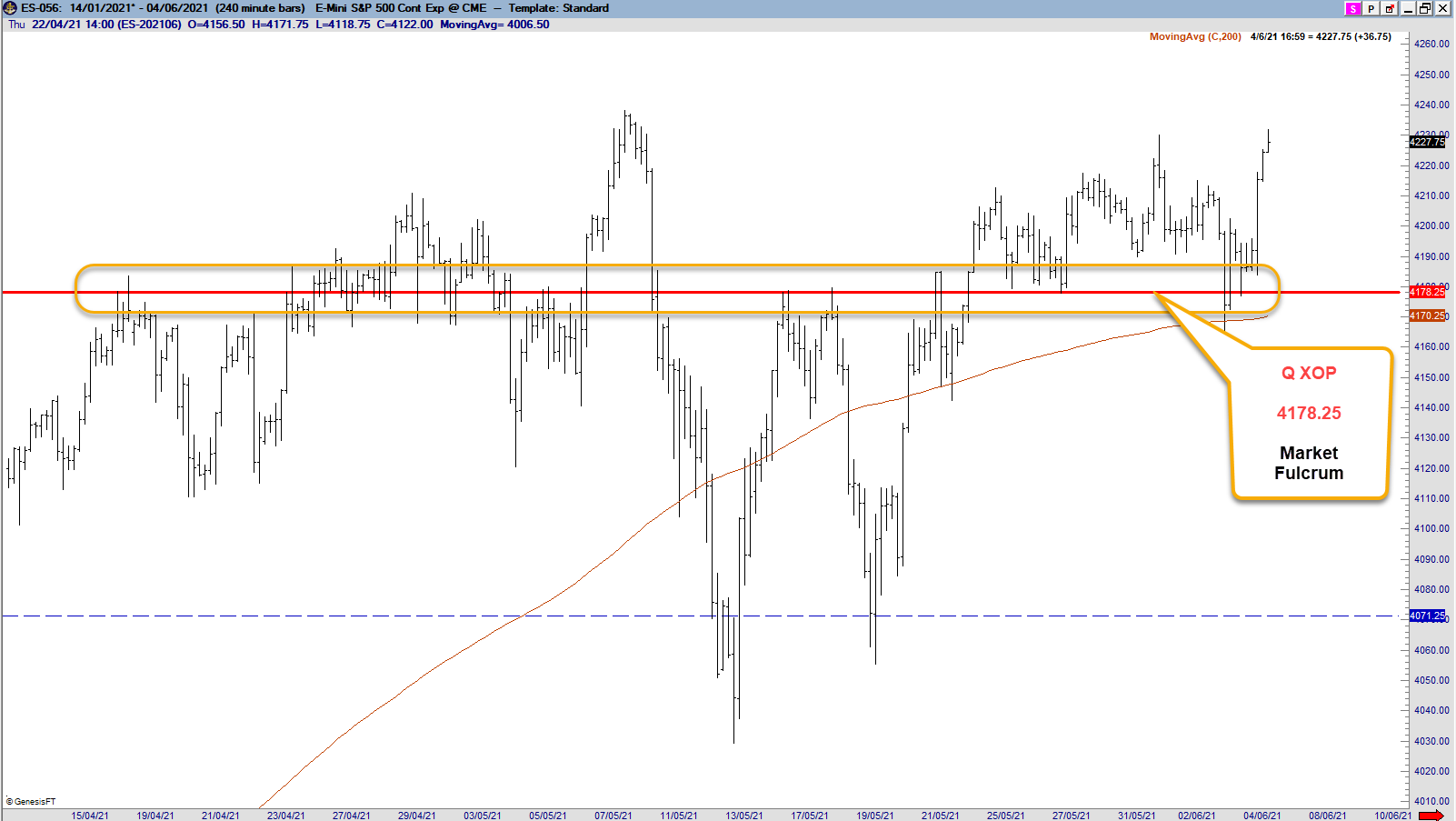

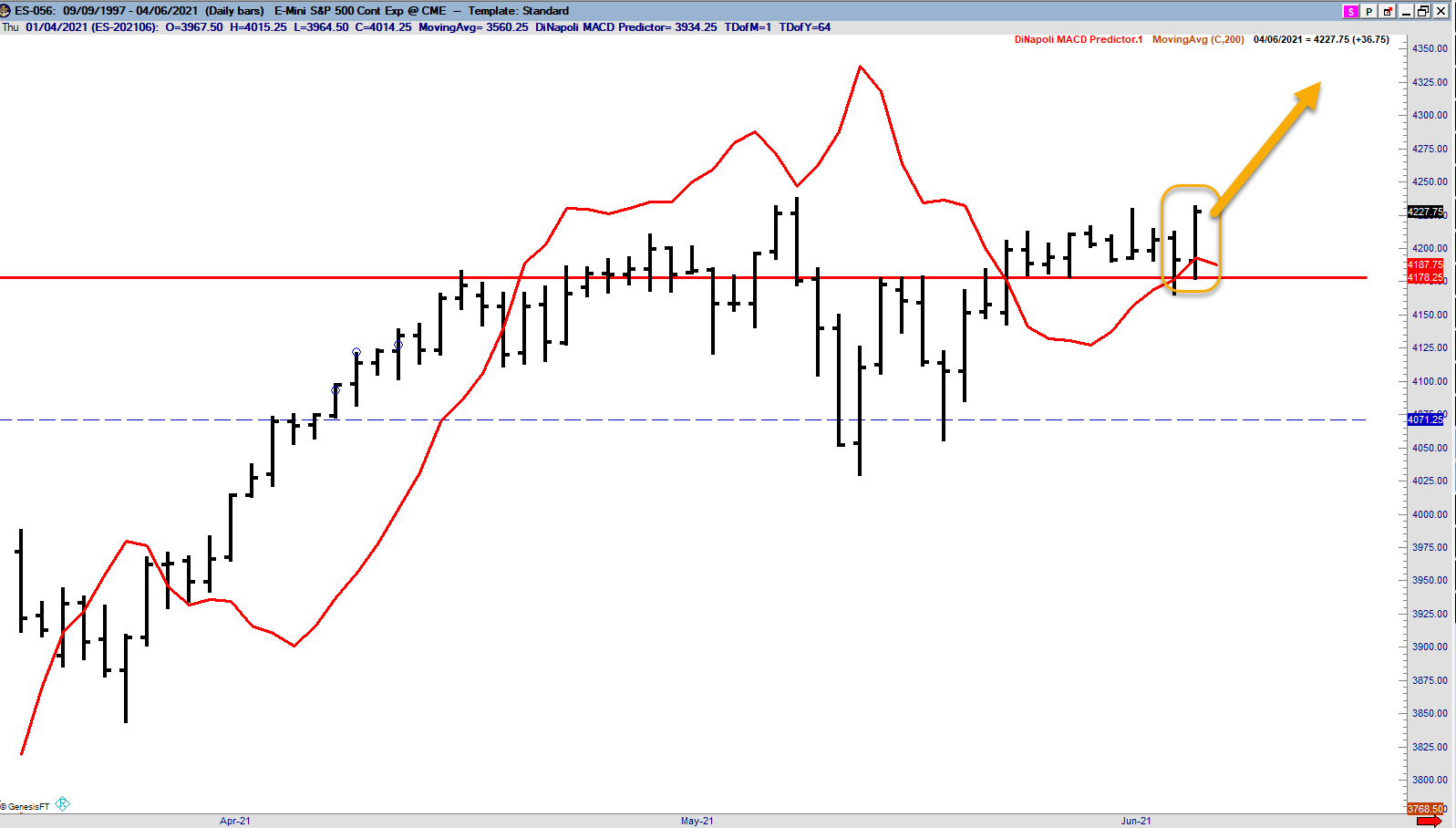

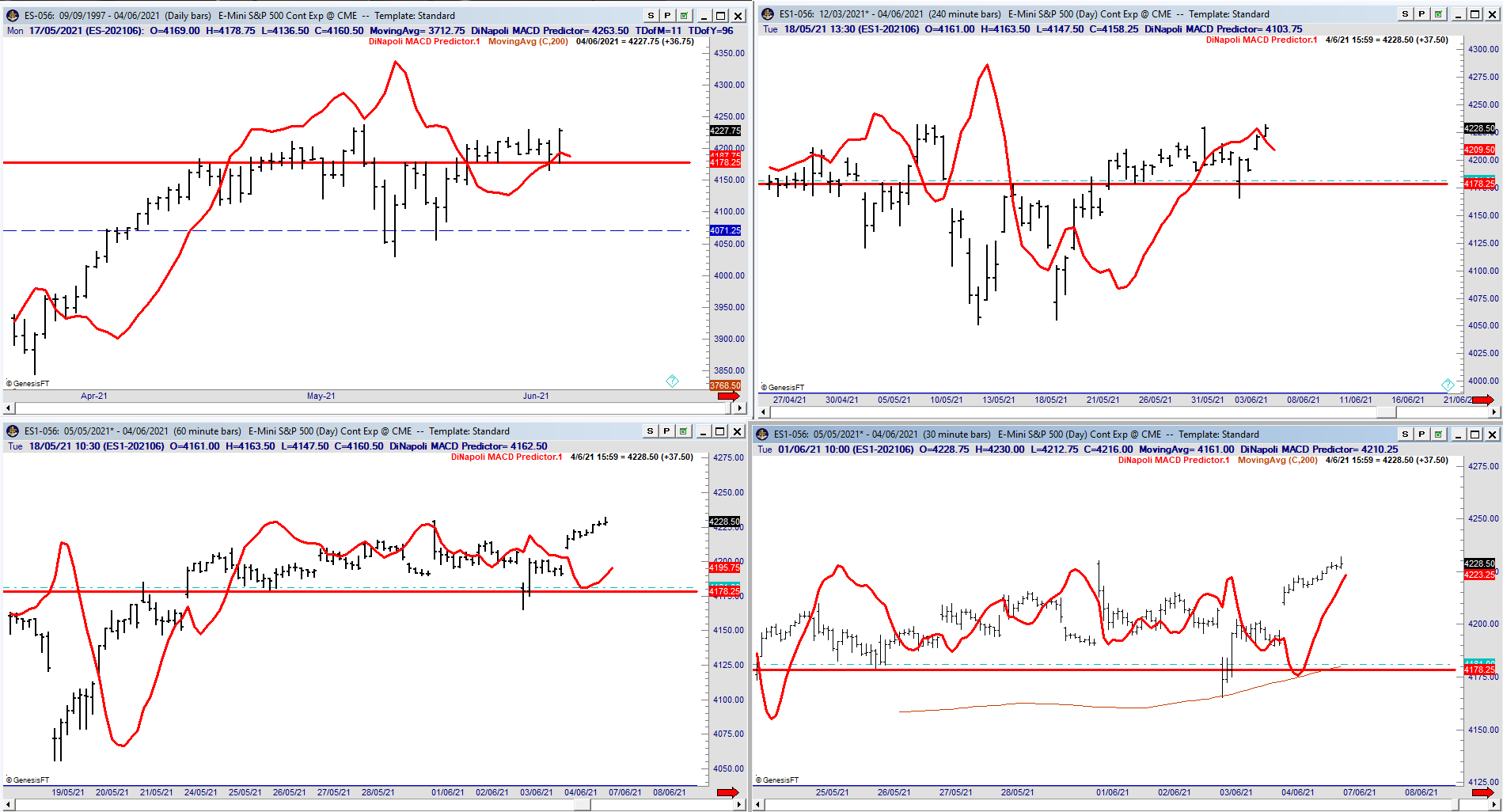

For several weeks we saw market volatility around our Q XOP ( 4178.25), as markets digested Q1 Earnings, Biden's Capital Gains Tax, FOMC and Fed's position on interest rate and tapering, and more recently, Inflation risks.

While it is safe to say that Inflation is here - as evident in the run up in commodity and raw material prices, talk about hyper inflation was premature as we still needed more inflation data for this to have a longer term impact on markets.

So between the 'Reopening trade' and "Inflation Risk off trade", I've maintained a bias for the former.

And PRICE seems to have 'confirmed' this bias last week.

ES Monthly

Technically, both DJIA and ES futures are trading above its Q XOP node.

ES Daily

Crucially, we have a confirmed Stop grabber on the daily chart, as price stayed above Q XOP node last friday ( briefly tested it ), and ended the week near its highs.

Intraday trends were all pointing up based on last friday's close, so in the absence of an unexpec...