"Re-opening Risk On" VS "Inflation Risk Off". Have markets decided?

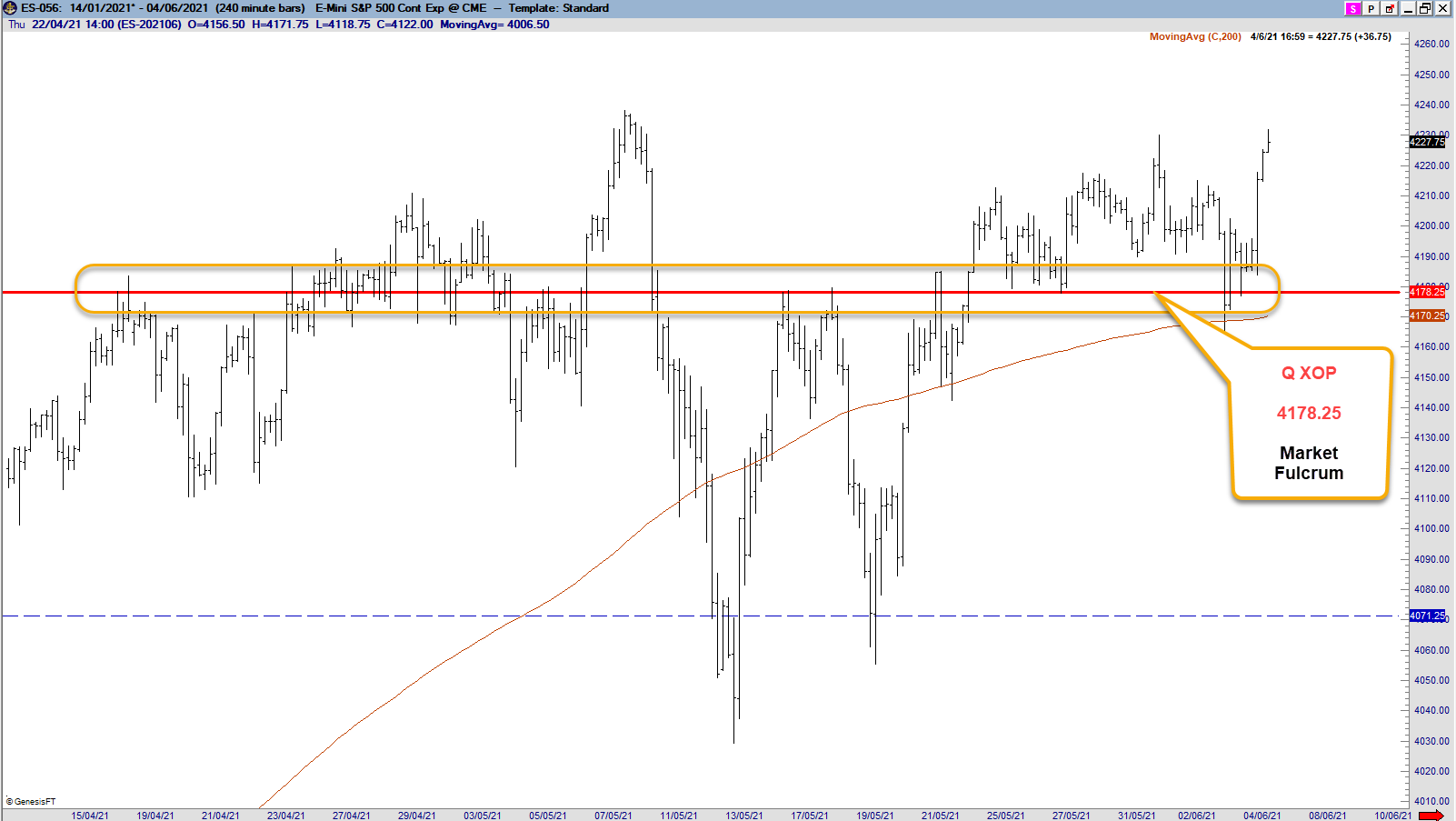

For several weeks we saw market volatility around our Q XOP ( 4178.25), as markets digested Q1 Earnings, Biden's Capital Gains Tax, FOMC and Fed's position on interest rate and tapering, and more recently, Inflation risks.

While it is safe to say that Inflation is here - as evident in the run up in commodity and raw material prices, talk about hyper inflation was premature as we still needed more inflation data for this to have a longer term impact on markets.

So between the 'Reopening trade' and "Inflation Risk off trade", I've maintained a bias for the former.

And PRICE seems to have 'confirmed' this bias last week.

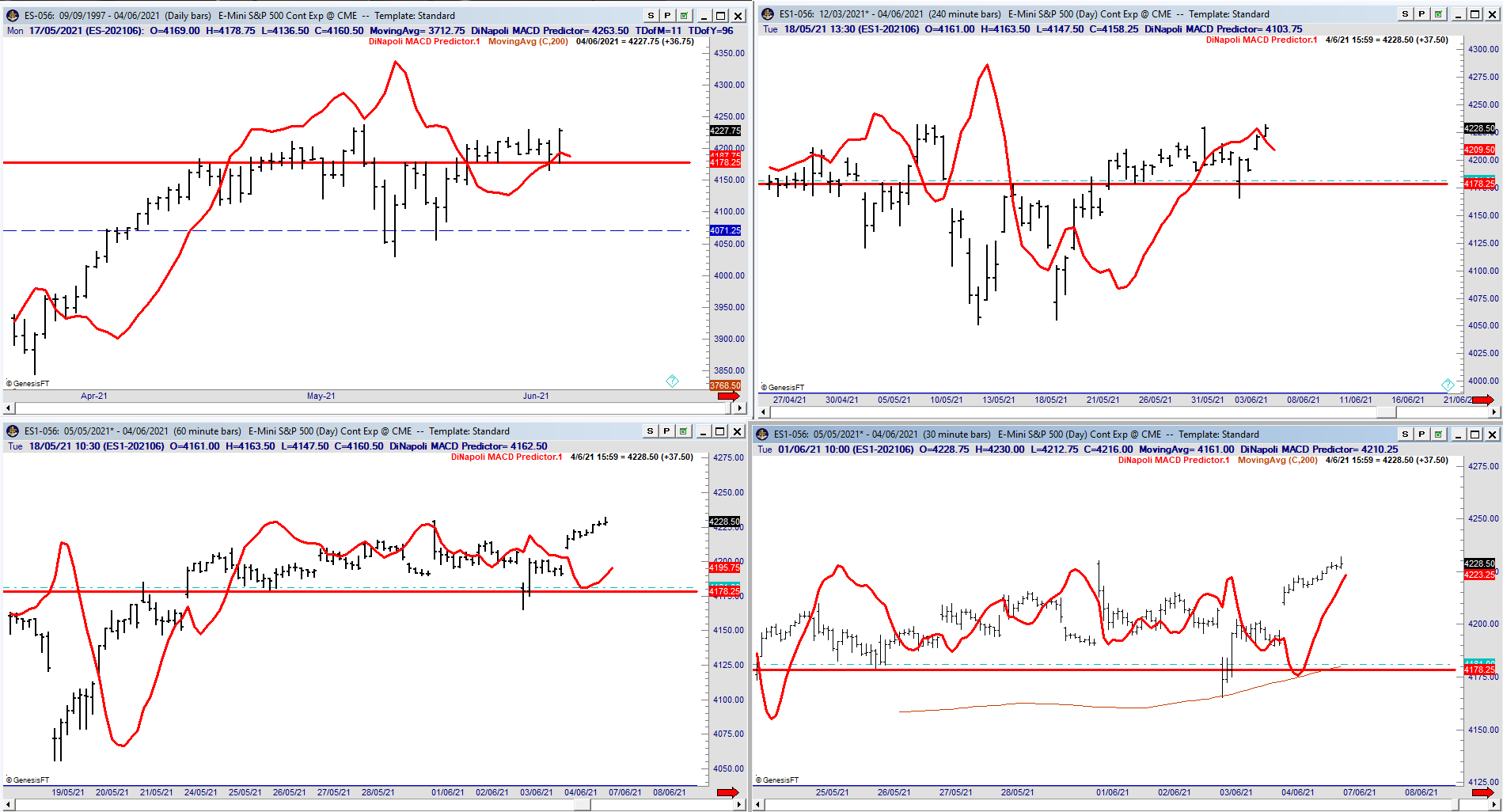

ES Monthly

Technically, both DJIA and ES futures are trading above its Q XOP node.

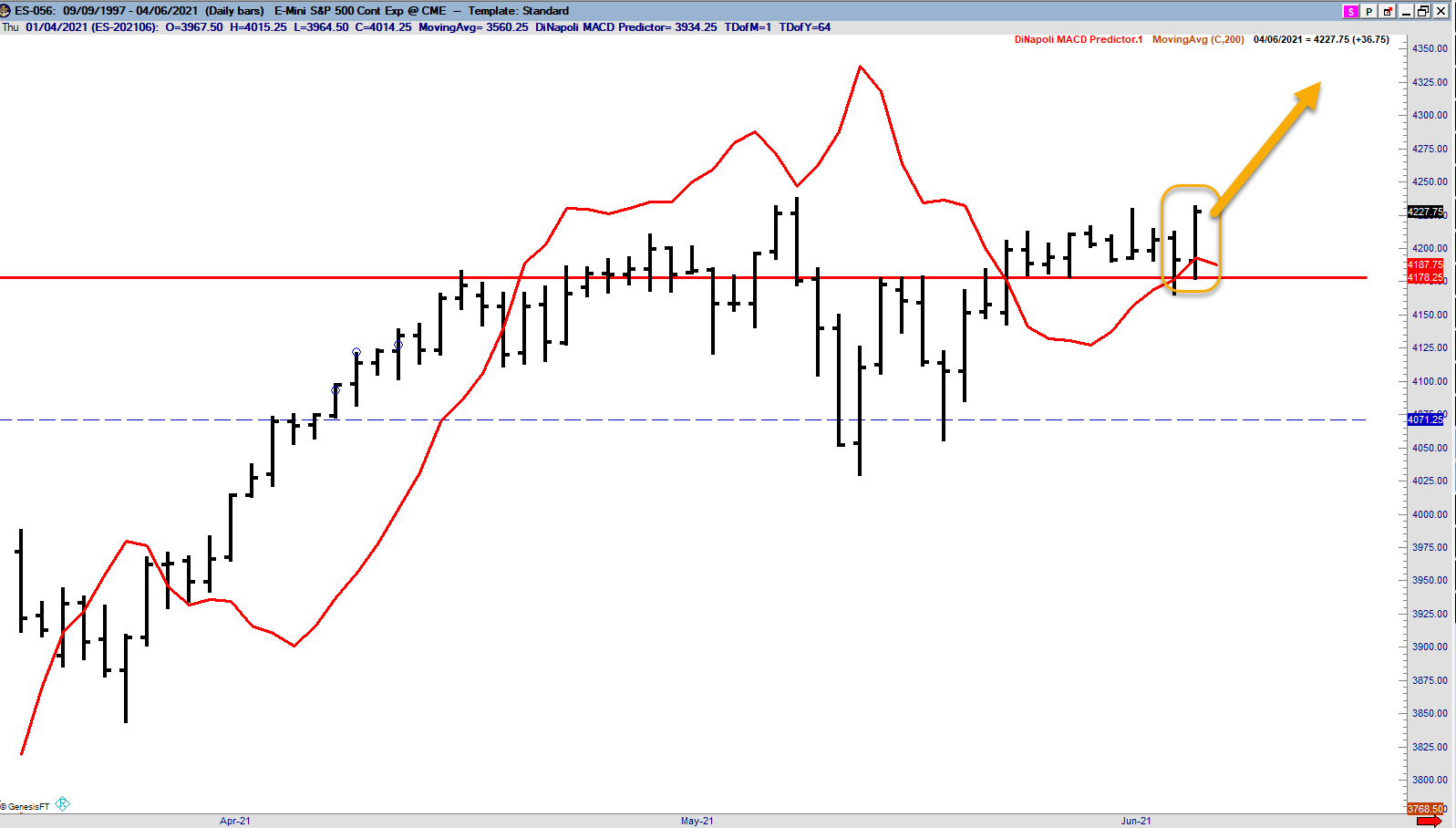

ES Daily

Crucially, we have a confirmed Stop grabber on the daily chart, as price stayed above Q XOP node last friday ( briefly tested it ), and ended the week near its highs.

Intraday trends were all pointing up based on last friday's close, so in the absence of an unexpected catalyst and sudden price reversal, it is safe to say that markets have made its decision with regards to where we are going to trade from here ...

In the short term, we should move away from 'Inflation Risk off' and back towards "recovery Risk on" as investors revert back to chasing returns in this low interest rate environment.

At least this is what PRICE is telling us based on last week's action.

Despite obvious headwinds, US equities want and should trade higher - at least for the time being.

Best of trading,

Joseph AuXano

DiNapoli Trading Academy

PS. Stay tuned for a video dedicated to this 4178.25 number that wallstreet seemed to have been so fixated on.

You can watch our latest videos at our Academy youtube channel.