Way of a Trader Blog

24052021 US equity Indices ready to make its decision?

After consolidating at Q XOP for the past few weeks, which saw unprecedented market volatility in various markets, I think the market is ready to make its decision/move...

if it hasn't already.

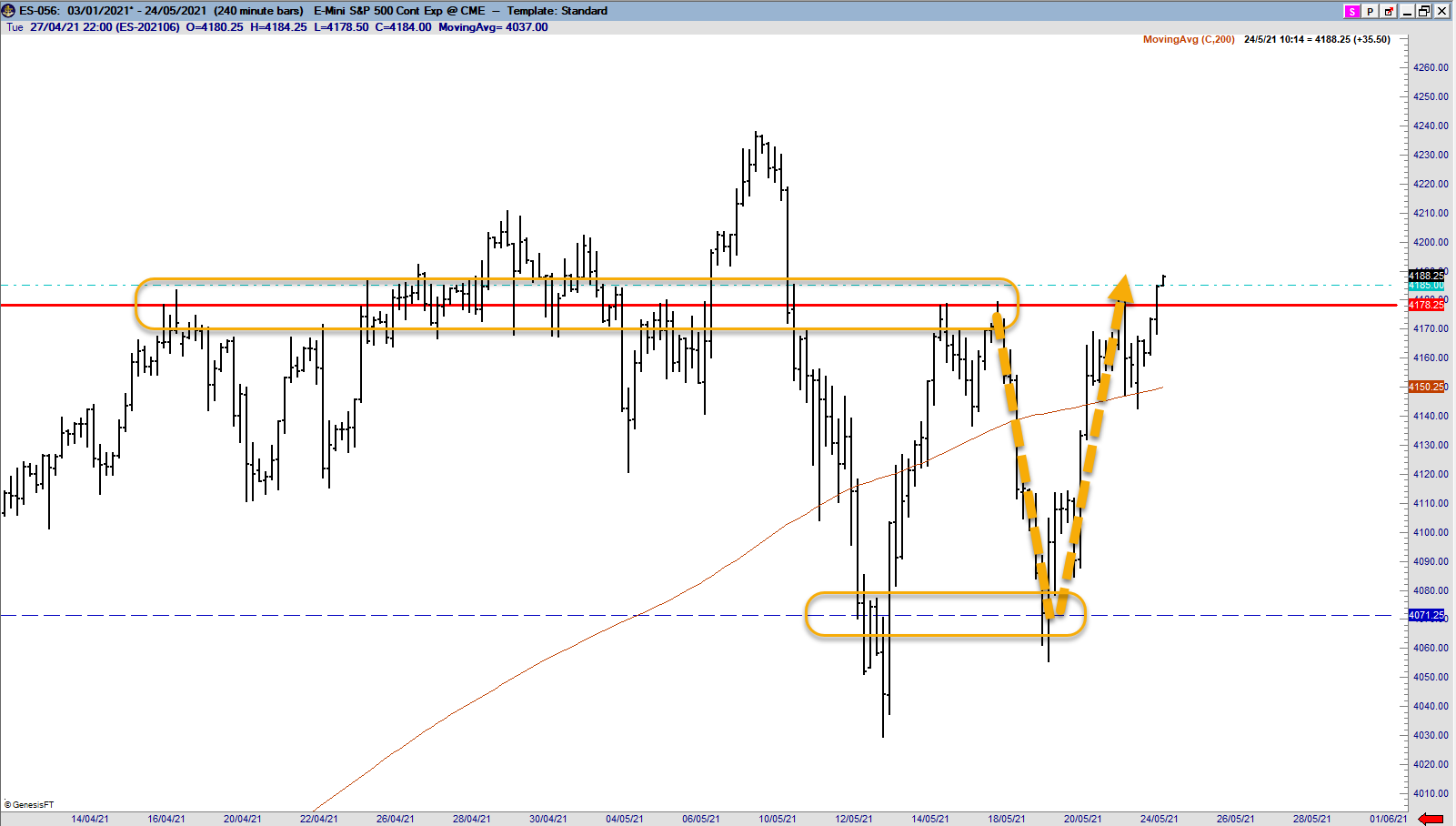

ES-056

Last week saw us consolidate further between Q XOP and RV M COP...

We are seeing a strong open on Monday...

Multi timeframe analysis ( Intraday ) suggests to me that we will likely push on from here ( to the upside ).

Watching DP on Daily.

So far what I am seeing from price action - is confirming my biases - for the past weeks,

i) YES - inflation is here.

ii) YES - There is Risk for Hyper Inflation - however it is still pre-mature for markets to make a decision based on that - on incomplete data. We still need more inflation data, as such I saw the sell-off in equities due to inflation risks - as being 'transitory' even if inflation isn't.

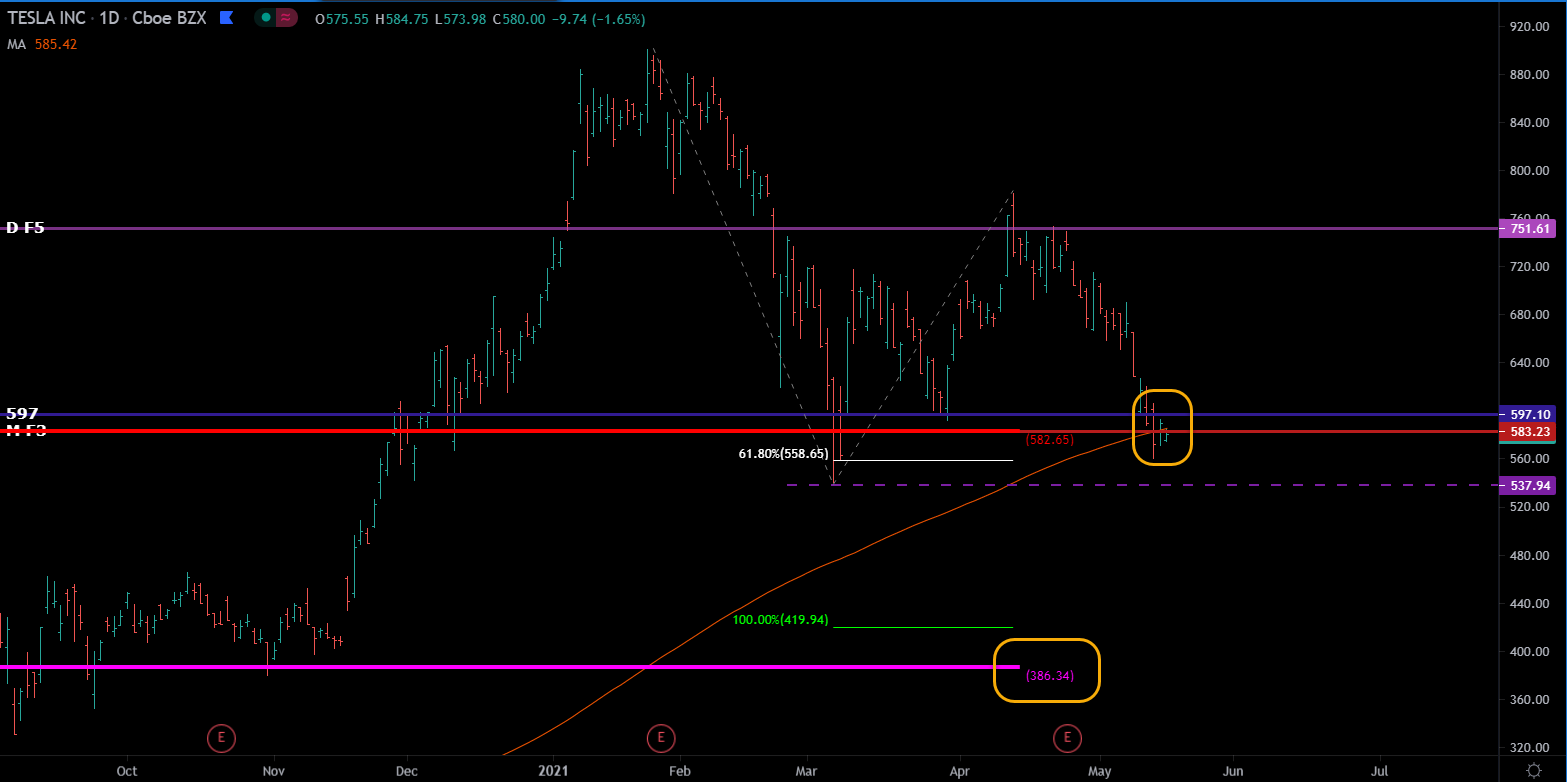

TSLA

iii) TSLA and many Tech Growth stocks were trading against their 200MAs, and as long as they stay above it - than their long ter...

17052021 Markets at important Technical levels setting up for moves

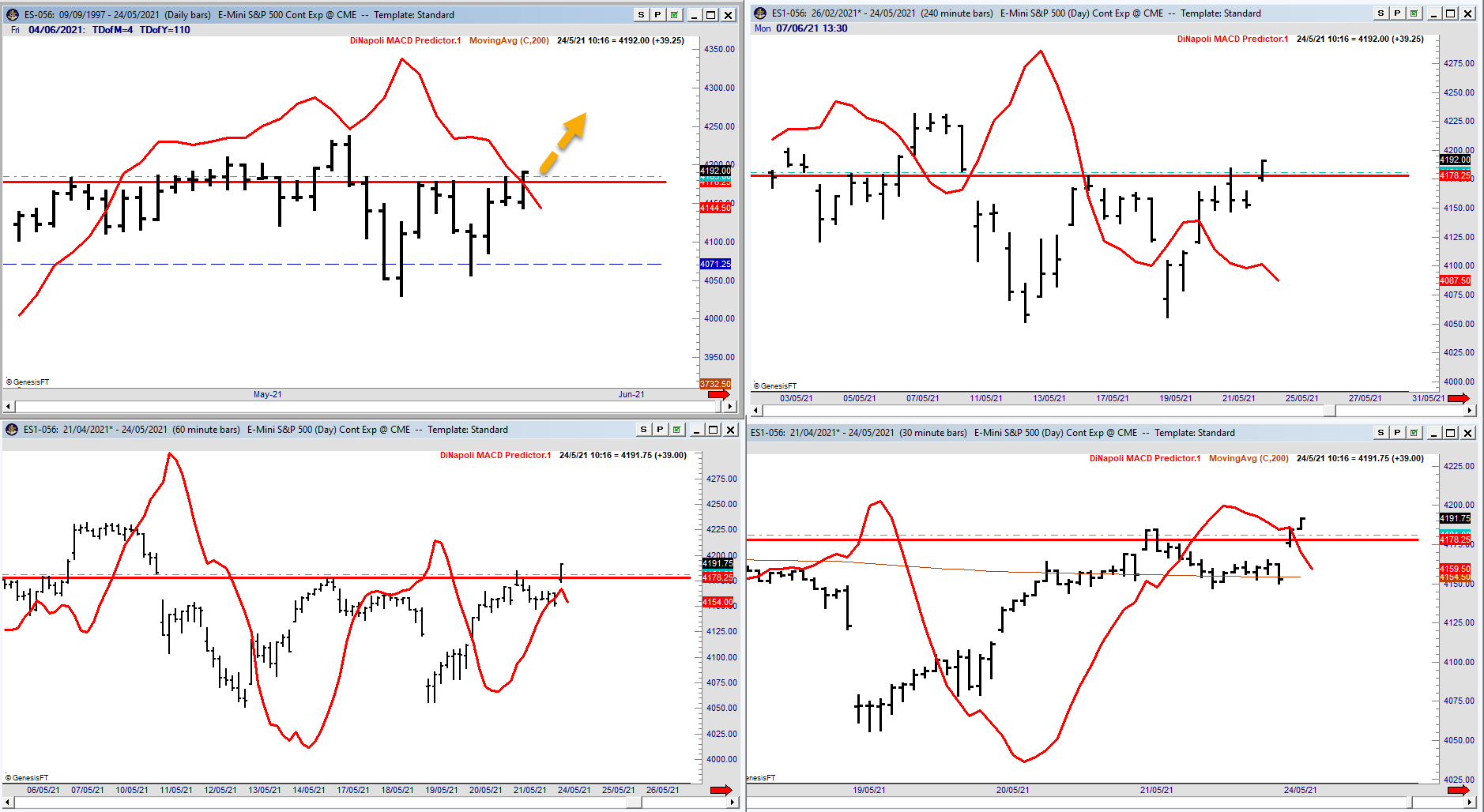

ES

Risks of a broad market sell off due to inflation ( off Q xOP ) is real, as long as we continue trading below Q XOP.

At minimum we should sell further consolidation move today, to retest recent lows, with 30min DP turning down at the open.

TSLA

TSLA opening the week again at its 200ma - with a impending move happening soon.

BTC

Bitcoin is trading near OP Agreement.

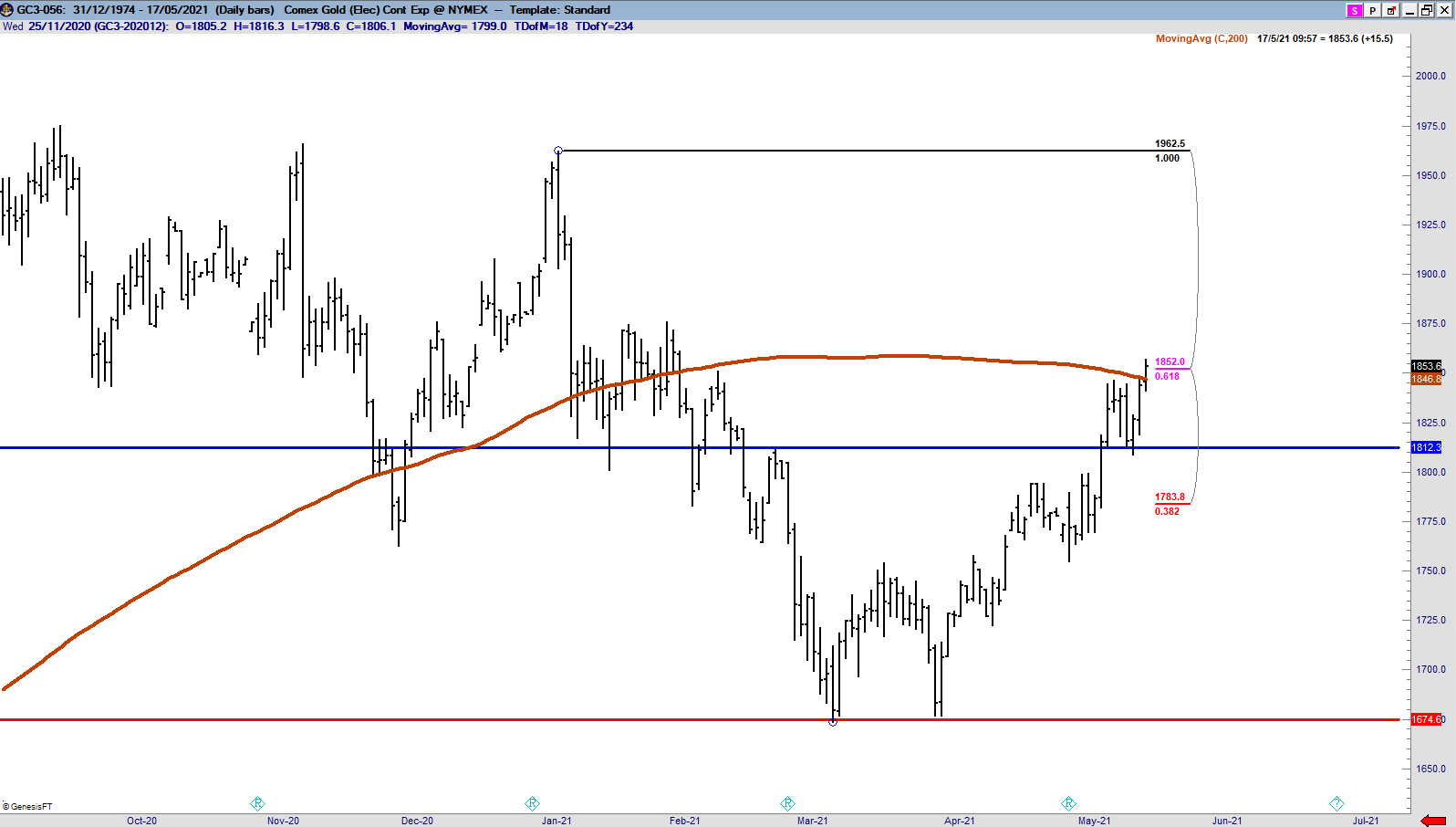

GOLD

Gold is trying to break out of its 200ma.

As things stand today, It looks like

i) Equity Indices looking to sell off ( due to inflation fears )

ii) TSLA trying to bottom here at its 200ma

iii) BTC nearing a buy opportunity

iv) A break above its 200MA on GOLD will confirm to us the inflation story.

13th May 2021 Long TESLA short ES Futures Part 02

Just want to do a quick update on the trades on TESLA and ES

As a follow up to my previous post...

ES continued its slide down, hitting support at Daily F3 (4040.50) and I was able to lock in my profits there.

We have since bounced off that support node and ended today's session right against important resistance

I didnt like the way we close - so I initiated a new short position around here, with stops above today's high.

While I did book in some profits on the bounce on TSLA when it covered the gap,

I'm willing to take some heat on my remaining long position as originally planned.

We broke below its 200ma, and found support intraday against Daily COP ( 557.75), before trading back towards its ma.

Its the first bearish close below its 200MA but we still remain above previous structure lows at 539.49... So I am still expecting an ongoing battle to play out between TESLA bulls and bears at these levels.

If I get stopped out of the trade, I get stopped out.

Fundame...

Long Tesla ( from 580) but short ES ( Q XOP -4178.25 )

Earlier today TSLA was trading 578 during pre-market...

Nasdaq futures, and Tech stocks were selling down hard...

But as we all know, pre-market selling is often not indicative of how the market will trade, during regular trading hours.

The Game plan (watch video) for Tesla was to buy at around 579, which was a confluence of support, namely

Monthly F3 + 200MA + Daily Over Sold ( based on Oscillator predictor ).

And that was what I did.

Got filled on the trade during pre-market at 579, and was immediately in good profits at the open... as TSLA quickly traded back above its 200ma....

Despite a host of negative news coverage near the open today,

Tech stocks in general were also sitting at critical support levels ( did not break ), which gave me further conviction that my entry on tesla was a good one.

However, the market also traded in a manner that I didnt wanted to see.

The ES Broke back below its Q XOP ( node ), on a break of an established trend line..

Combination...

Why TESLA stock is trading lower today after Q1 earnings and what you can learn from it?

Tesla Q1 earnings beat both top and bottom lines, numbers were great but the stock is down Tuesday, closing at 704, down 4.53% from Monday's close ($737.88)

I just uploaded a video today ( WATCH HERE ) explaining the real reason behind this drop, from the lens of understanding market mechanic's, the general public's predisposition going into 2021 Q1 earnings, and how the powers behind wallstreet had the incentive of moving prices down against public opinion ( eroding the huge option premiums going into the announcement.

( BIG FAT PROFITS FOR WALLSTREET BANKERS )

Intraday price action supports our downside bias, with a triangle break to the downside... and a weak close below 30min Dinapoli F3 ( .382 fibonacci retracement level )

Because of all this, I think there is further downside on Tesla this week, until we hit important Higher timeframe Fibonacci support nodes as indicated previously in the report.

These technical levels are calculated using advanced Fibonacci techniques ...

7 Earnings Reports to Watch this Week (Q1 2021 Earnings )

If you’re going to keep an eye on earnings for just one week this quarter, it should be this week.

With major indices once again at the highs heading into the peak of earnings season, it’s obviously a huge week for U.S. equities. Of course, we’ve seen this story before.

Here are 7 earnings reports to watch this week :

- Tesla

- Alphabet

- Microsoft

- Shopify

- Apple

- Amazon

While one should approach trading each stock individually, watching and trading the E-mini S&P futures can afford us with early indications and clues to how the broader equity markets will trade this week.

Looking at the Dow Jones Industrial Average

We have important Quarterly XOP resistance at 34594.45.

On the E-mini S&P futures :

ES Monthly chart

We closed last week below Q XOP (4178.25) after the volatility around Biden's proposed Capital Gains ...

26th March 2021 Friday Live Trading

Markets surged more than 250 points into close on Friday, with the DJIA up 453.40.

ES30

Dynamic Pressure (DP) on the 30 minute chart would have given you a clue, and possible trade entry... before the rally.

Much of the move happened in the last 30 minutes of the trading day, which has been happening frequently lately.

Here is the LIVE Trading Action.

Joseph AuXano

24th March 2021 Live Trading ( The Last 30 minutes )

ES60min

Today, the market found resistance against previous structure highs...

Critically it was also a convergence of

i) my MA on the 60min chart

ii) Trend line ( Triangle )

ES240

The market moved towards my Target at around 3883.25, where I booked my profits, right at the close of the trading day. The move very often happens during the last 30 minutes of the trading day, where the professionals show their hand, and today was no exception.

Watch LIVE TRADING ACTION of this move HERE.

Another day of good trading,

Markets closing & sitting right at D f3 support ( why is that not surprising? )

Lets see what tomorrow brings.

signing off here.

Best

Joseph AuXano

Powell and Yellen Testify on Economic Recovery

It was the first time both current Fed Chair and Ex Fed Chair, Powell and Janet Yellen testified before congress, addressing issues like Inflation and the current economic recovery.

23rd March 2021 Fed Chair Testimony

Today's trading however was pretty straight forward.

ES60min

Market action saw price consolidate within a tight triangle during much of the build up towards the event, before the eventual break of the triangle to the downside.

It was clear that the market was about to make a decision, and an impending market move is near.

ES 5min

Once it became evident that we have broken to the downside of the triangle, a retracement back to f3 would have given you a nice fill.

With XOP being the LPO.

Watch Live Trading from the Trading Room

Not all FED days are easy - in fact most high impact events are really tricky to get right, both prior to the event and post event... but today was more straight forward.

430am over here... another day of trading, possibly looking t...

Gamestop 31/01/2021

As most of you know by now - there is an ongoing battle playing out between

retail traders ( lead by Wallstreet Bets ) VS Hedge funds, on Gamestop.

We have always known and educated the public on the role of market manipulation in the financial markets, and while it is being done covertly behind the scenes by the hedge funds of the world, manipulating the order flow/news, to see an army of retail traders banding together ( publicly on the basis of free speech ) to beat Wallstreet at its own game - has definitely caught our interest.

I must say I'm impressed and moved by intent, strategy and solidarity behind this movement to 'screw' the hedge funds - and it would be refreshing to see the 'little guy' beat the 'Big guy' for a change.

Having said that there will be longer term consequences/implications on the way the game is played ( Power of social media ), which is why we are seeing alot of coverage in the press from politicians, brokerage firms, hedgefund managers, individual r...