March 8th 2020 Monday

We just hit 109K confirmed cases of COV19 worldwide.

Italy Just surpassed S.Korea to take up #2 spot for the most number of cases, outside China.

If you look at France, Germany each with 1000 cases, followed closely by Spain and the USA.

This is no longer an Asian Epidemic. It is an European Epidemic.

The markets are already reacting to this during Asian Trading Hours now, with S&P futures trading down more than 7% at this time.

Here is why all this is a big deal.

We are in a Pandemic. Here is why.

If you look at the cases in within China, we looked to have reached a plateau.. new cases have gone down significantly. What ever quarantine measures the Chinese have done - they seem to be successful. This is good news. It is also bad news for the economy and I will talk about that in a bit.

Now look at the number of cases outside China. Since Feb 4th we have started to see significant day to day increases.

We saw what happened in S.korea. How it was just under 300 a couple of weeks ago, and now we stand at 7313.

Italy now has 7375.

Iran - 6566

Their numbers have kept doubling

France and Germany each has 1k.

USA has 500.

They CANNOT contain this, so expect numbers in other countries to continue doubling as well, and follow the path of Italy

Now there is a Trend to this.

Governments initially tend to play down the the COV19 situation to alleviate public fear so that the economy moves on. Most governments are under reacting to the situation.

If and when the COV19 situation turns into an epidemic, like in Italy, S.Korea, only than will DRASTIC action be taken to attempt to stop the spread.

And this is why it is bad news for the economy.

IF you look to China, the orgin of COV19 - cities were placed under complete lockdown.

Millions were quarantined. So far their solution seemed to be the only way to slow the spread of the virus.

S.Korea have done the same.

Italy this week, has followed suit.

Here some videos showing what its like in Italy, S.Korea, China, when cities are placed under quarantine. There is nobody in the streets.

https://www.youtube.com/watch?v=-xdfnuBfriM

It is not difficult to imagine the economic impact to these countries.

Now I think it is a matter of time, when, not if, for cases outside china to surpase China.

This is because most governments worldwide are currently still under-reacting to the situation.

They will only undertake drastic measures once the situation worsens.

The solution - is not a vaccine as it will take more than a year for FDA approval, and for it to be ready for mass production and distribution.

Governments World wide will eventually model after the Quarantine measures put in place, in China, S.Korea, and now Italy, because it is the only solution that looks to be working so far.

When this happens - The effect to the GLOBAL ECONOMY will be significant.

There will certainly be an impact. IT is not short-term. so expect more Downside risk in the markets.

Now This is my analysis from a fundamental perspective.

But I'm a Trader.

Lets Look at what the Technicals say

This is the Yearly Chart of the DJIA.

We have massive massive multi year resistance at the 28520 area on the DJIA.

I've highlighted the importance of these resistance nodes as early as Dec 2019, in my Weekly Focus Newsletters.

Yearly chart

We have yearly OP resistance.

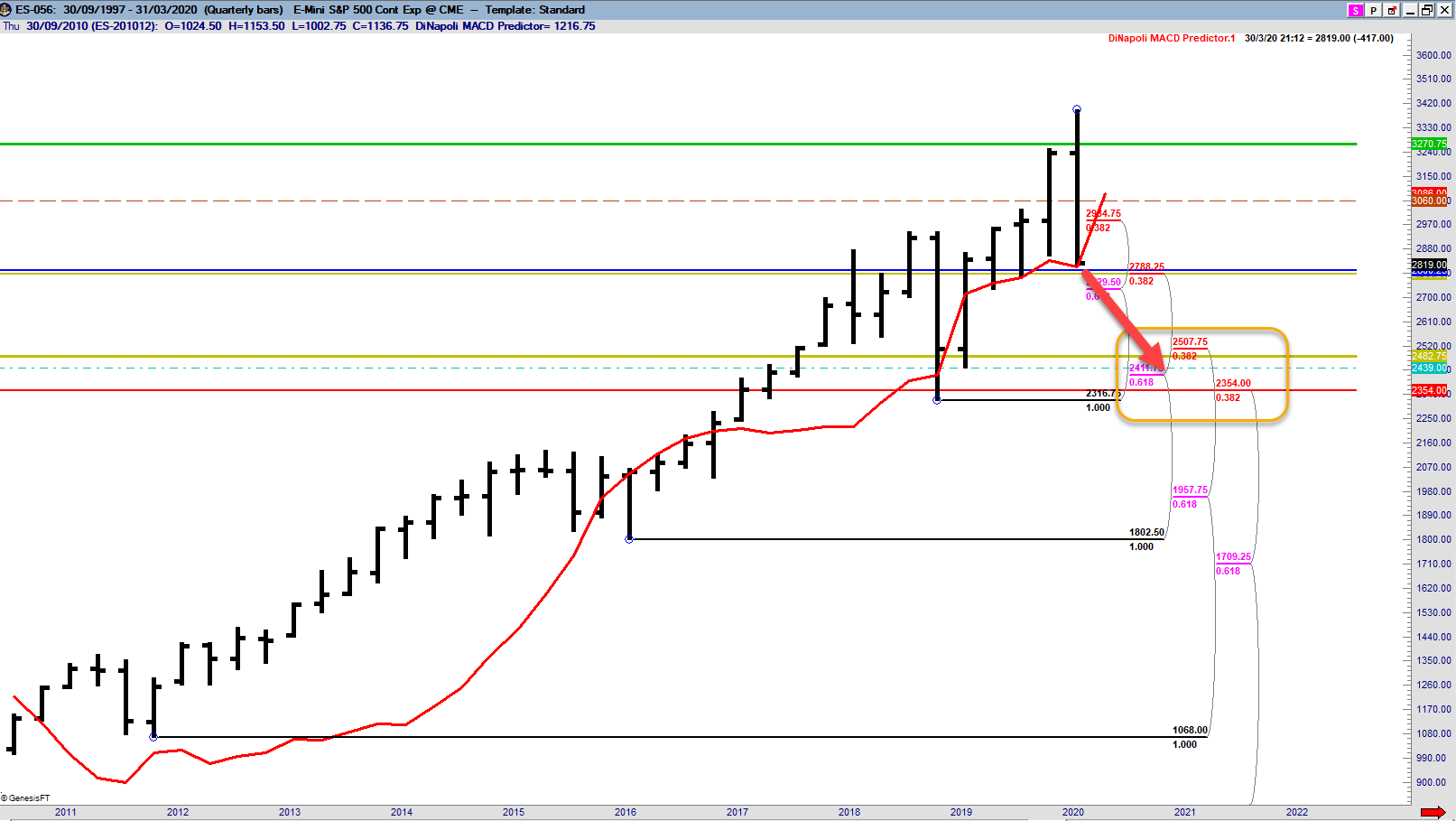

Quarterly Chart

We have a confirmed RRT.

RRT's typically reach an OP target minimum, so I'd expect us to eventually trade here

There will be significant rallies off these pre-calculated DiNapoli Support nodes.

Whether or not they form lasting bottoms, will depend on how the COV19 situation develops.

Monthly chart

Monthly MACD Predictor went into a strong sell.

Weekly Chart

There is going to be critical support here at 2800.25 level.

Confluence Agreement level.

We are also extremely oversold.

You will want to be watching this very closely today. I'll explain why in abit.

If we go down to the daily chart,

You can see here that we interacting with the 200 MA.

IT was also against Daily F3 resistance.

This was also when I went short this market.

When I did it, I shared it with my Weekly Focus members, on Thursday March 5th 2020.

I am short the market because all timeframes from 60min all the way up to the monthly chart were pointing down.

I announced that everything was pointing towards a flush to the downside

That this could be the beginning of a significant move down.

On friday March 6th, I followed up on Thursday's post

mentioning that I am maintaining my downside bias

I anticipated that we may soon see the biggest single day decline in wallstreet's history.

I actually predicted this 2 days in advance.

You can see on March 5th 2020 I did another sharing with our members, to explain what I see happening, and why it is significant.

Which brings us to where we are trading, right now.

The markets opened monday with a gap down.

And within 5 minutes of trading we traded more than 100 points lower on the emini-S&P futures market.

This led to a trading halt .

When Wallstreet reopens for trading on Monday, here are the levels to watch.

A 7% decline in the S&P500 from the prior's day's close would trigger a level 1 breach, where trading is halted for 15minutes.

That level for regular trading on monday, is 2764.30.

Level 2 Breach

The next treshold is 13%. A decline in the S&P by that much would similarly trigger a 15minute halt. To trigger a level 2 circuit breaker on monday - the index would have to drop 386 points to 2585.

IF any of this happens after 3.25pm eastern time, trading wont be interrupted.

Level 3 Breach,

IT takes a 20% drop in the S&P to trigger a level 3 circuit breaker.

IF this happens at any point in the trading day, marketwide trading is halted for the remainder of the day. To hit level 3 on monday, the S&P would need to fall 594 points to 2377.90.

Given how we dropped 4000 points on the DJIA in a week just 2 weeks ago, I wont be surprised if we see another 4000 point drop this week which will take us down to critical Yearly support nodes.

I will go as far as saying this.

IF the algos and high frequency trading systems really kick in on monday, we could drop that much within a day, if we hit limit down. Given what I am seeing - I'm prepared for this possibility.

Here is what I am looking for on monday.

we will be opening right against critical weekly support.

Daily COP Weekly F3 Agreement level.

Normally I would expect markets to support and have a bounce here.

I am already in deep profits with my shorts, and Normally I will lock in my profits here without hesitation.

But I have a feeling that these are not normal times.

If we break below this COP Agreement level... WATCH OUT!

The algos will really kick in, and guess what, there will be NO ONE on the buy side.

Now I am not saying that any of the above will happen, in fact my first expectation is for us to bounce off COP. I will exit my shorts and even go long if I see support manifest.

But knowing the structure of this market, you need to be prepared for the scenario where we hit limit down days and circuit breakers on monday - especially if you already learn about market mechanics from the webinar.

Today promises to be a critical trading day for global markets.

This is what joe calls the Olympics of Trading.

My goal in this video, is not only to give you a sense of how we use our techniques, but also, show you that Preparation is Key to Success in Trading.

If you have not already attend the Webinar Training - I encourage you to do so, to learn about market mechanics, how markets work, role of skynet and algo trading.

You will get a better sense of what we are seeing right now in markets.

You will also get a basic understanding of how our techniques work.

We have additional learning resources.

Weekly focus - will provide regular market updates like this, on a weekly and daily basis.

IT will help you build critical experience. Right now we have a trial offer going, so take advantage of it while it lasts.

To really learn this - we have the DiNapoli Academy Program. Many of your questions, that you will have, will be answered within the online course.

Finally, we have the DiNapoli Masterclass - Private seminars designed for traders serious in mastering this. During the masterclass, we will cover examples such as these, and trade breakdowns taken from weekly focus posts... to take your mastery to the next level.

Thats all from me, for now.

Best of luck, trading later today.

We are both going to need it!

Joseph Auxano

Take care.