10 Days to US Elections - What the Charts are saying and what to expect!

It has been a while since I send out a blog post and a big part of that has been due to the impact that COV19 has had, on our way of life...

Personally I've had to make adjustments to the way I go about my daily life,

but I am sure it is the same for all of us, as we learn to deal with this new reality.

Having said that, day trading the markets have gone incredibly well during this period, with the unprecedented market volatility providing for good trading opportunities.

With the nov 3rd 2020 elections coming in about 10 days, I'm sure alot of us are wondering how markets will trade!

Making predictions on how markets will move, especially post election is futile, given QE and monetary stimulus will continue regardless of the presidential outcome, while we all are still learning to deal with longer term impact of COV19, as we await the possibility for a viable vaccine.

There are just too many variables, and market uncertainty, to chart a course for how the markets will eventually trade longer term...

But in the short term, we may gain some clues from the charts, and here's what the charts are saying right now :

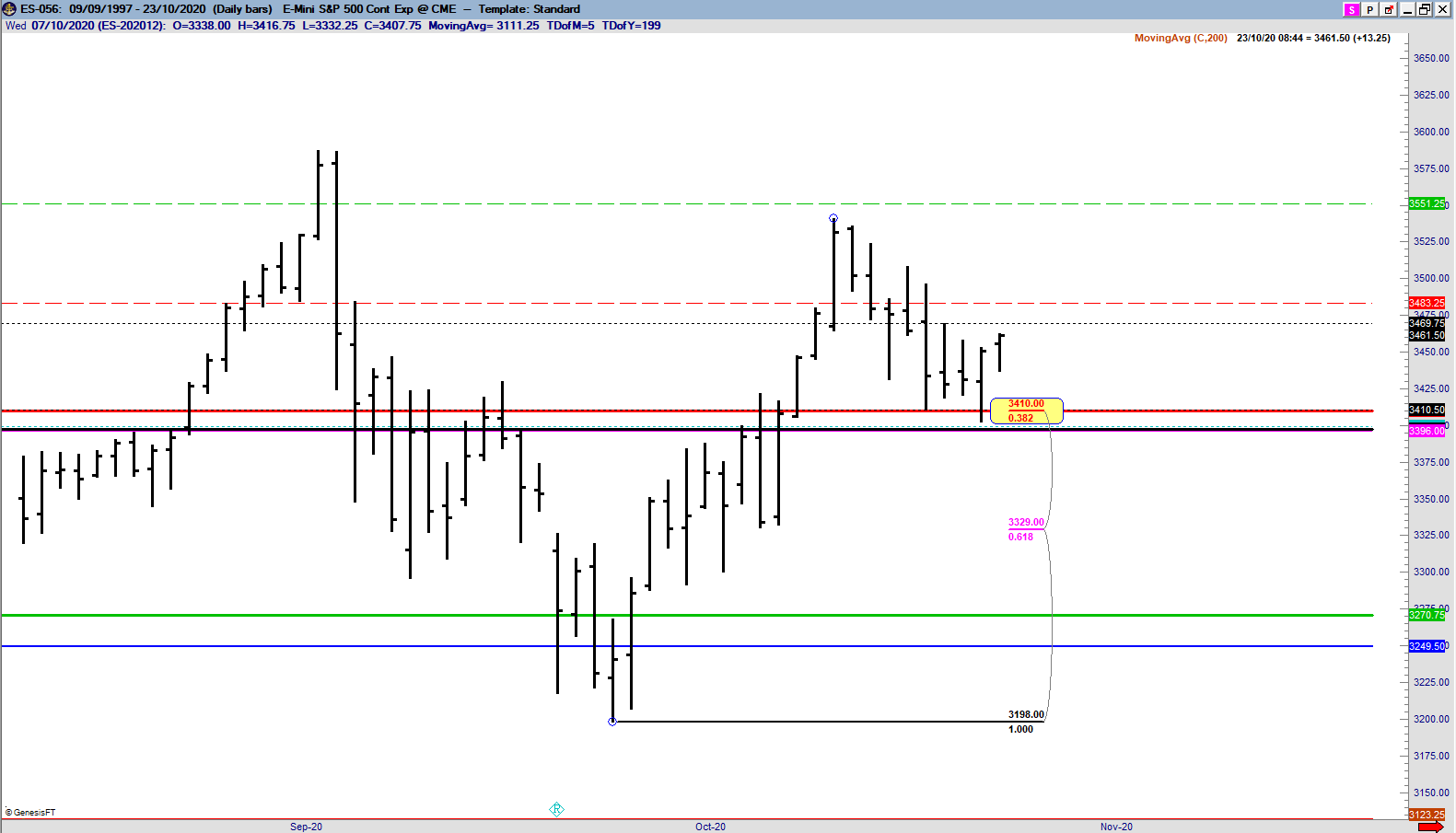

Earlier this week, we had a Triangle pattern on the Daily/240min Timeframe Chart.

We broke to the downside, and typically this gets traders short the market.

We hit the 0.382 F3 node on the Daily chart, which supported the market.

We thank reversed sharply back to the upside, closing back above the triangle breakout.

Details of this directional pattern can be found on page 97 of our book, Trading with DiNapoli Levels, and also discussed in detail in the DiNapoli Academy Online Program.

But what this tells us, going into the nov elections, is that there were traders positioned short just a few days ago - with this break of the triangle - only to now find themselves on the wrong side of the trade... and when you have traders positioned the wrong way... and you understand the psychology of how markets work, it is easy to understand why my bias is for the market to rally, going into the nov elections..., or at minimum for the next few days...

and this Context is based on a solid trading pattern that has served us well, for decades..

Dont get me wrong - the market do not have to trade higher next week.

We trade the markets the best we can, constantly managing the trade and thus our risk exposure... Our tools have allowed me to interact with the markets 'safely', providing good risk reward opportunities...

We are here to make $, not predict where the markets will eventually go.

Intraday, we already had a significant rally with the confirmation of the Triangle Failure - we will see next week if this rally can gain momentum...

Now this is not the only reason for this post.

Recently, Joe DiNapoli did a radio show with TFNN Corp, which really nailed what has been going on in today's market environment... Every trader should be aware of this new market reality that we all face today.

Joe also discussed his take on current markets, and GOLD, heading into the elections.

Here are the links to 2 interviews.

All eyes will likely be on Nov 3rd 2020, and the markets, from a DiNapoli Trading perspective.

Hope it will serve you well.

Good Luck!

Joseph AuXano

DiNapoli Trading Academy